When you talk about the economy and the state of young people today, you will almost always here about how young people are drowning with student debt. I took this statement at face value, until a few months ago when I saw someone make a comment that college cost creep had largely slowed down. I didn’t follow up much more on it until I saw the recent Astral Star Codex post about the Vibecession data, and he confirmed that the high water mark for student loan debt was actually 2010 (Note that this is debt per enrolled student, so those numbers aren’t impacted by changes in enrollment):

His theory is that 2010 is around when large numbers of people first started maxing out the $31k cap on many government loans, and that that cap hasn’t moved. I think there’s two other things going on:

- The youth (16-24) unemployment rate was above 15% for about 4 solid years after the 2008 crash: 2009-2013. This is the worst youth unemployment since the early 80s and it actually hasn’t been replicated. The COVID unemployment spike lasted about 5 months (April-August 2020). It dropped back below 15% by September 2020 and was below 10% by June 2021. 4 years of bad job prospects leads to a “well may as well finish my degree/go back to grad school” type thinking in a way 5 months of bad job prospects don’t.

- 2012 is generally considered the inflection point for smartphones/internet adoption, and this opened up a lot of low cost options for online college. I don’t have good comparison numbers, but today in 2025 you can get a bachelor’s degree for $10k/year at Southern New Hampshire University, and they helpfully point out some of their “pricey” competitors are $15k/year. Adjust for inflation, that would be the equivalent of a 2010 student being able to get tuition for about $6800/year. I was not shopping for a degree at that time, but Google tells me you would have paid triple that for my state school that year.

Now you can find websites that say student loan debt is going up, but from what I can find these graphs don’t inflation adjust their data. The complaints about how a $100,000 salary isn’t what it used to be are accurate, but by the same token a $100,000 debt isn’t what it used to be. Looking at the top graph on this website for example, you wouldn’t know that a $17.5k loan in the year 2000 is actually about $34k today, remarkably close to the $35k they say 2025 graduates are taking out.

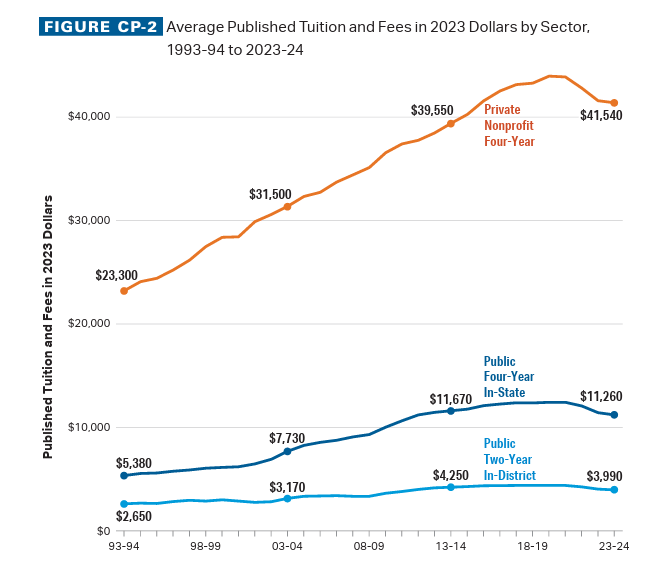

Ok, so that’s debt, but what about the sticker price? Well, the College Board puts together a pretty useful report on the topic that shows a few things:

For public universities, we see a slow down in tuition increases starting about a decade ago, and for private schools the change happens about 5 years ago. For all schools we see the inflation adjusted cost is currently lower than it was a decade ago. But wait, there’s more!

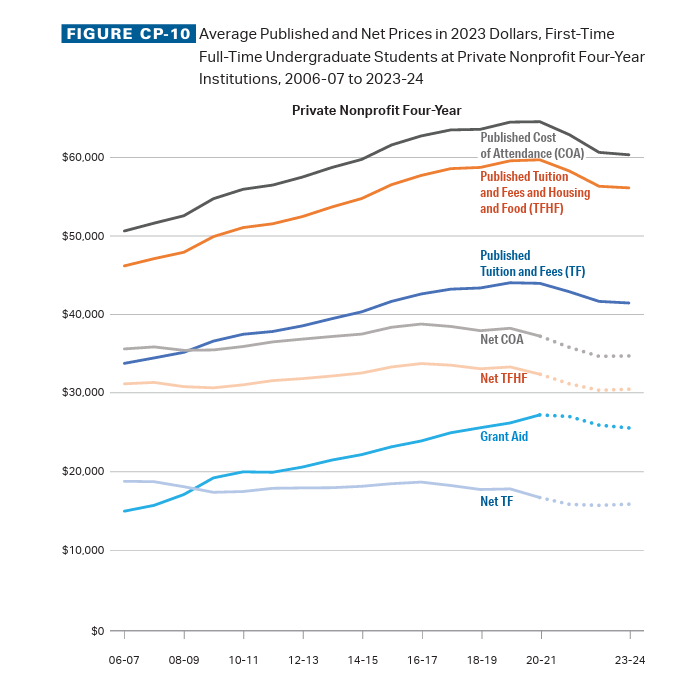

The above graphs are just the sticker price. The College Board also tracks the “real cost” after factoring in grants. Here’s the data for private 4 year colleges:

Note the “grant aid” line, which slowed during the 2008 crash, but then has been ticking upward starting in 2013 and hasn’t stopped. To emphasize, those are grants, not loans. That’s just money off the sticker price. According to the College Board, the net cost of attendance of a college in 2024 was less than in 2006. I won’t keep pummeling you with graphs, but for private 4 year, public 4 year and public 2 year colleges, the “real” cost peaked in 2016.

I am not an economist, but the numbers suggest a pretty clear story to me. When unemployment for those under 25 was high in 2009-2013, going to college, any college, seemed like a good financial move. For many, it probably was. Then, as employment picked up, students were able to get choosier and consider the cost of student loan debt in their choices. Very quickly colleges started upping the amount of grants offered, and then stopped increasing the sticker price. With recent inflation, the price increases actually dropped below the inflation line and now the real cost of college is dropping.

Additionally, technology improvements allowed online schools to start offering cheaper tuition at a large scale. This might have only made a small dent, except then the pandemic happened and traditional campus life was upended. This made the difference between going to a traditional college and an online college much smaller, and based on those I know with kids that age a lot of kids opted for at least a year or two at a cheaper online school rather than pay through the nose to sit in their dorm room all day. This put additional cost pressure on schools, and we see the prices tick down further.

All that being said, there is a not-small group of people who were pretty slammed by college costs: those who were coming of age during the 2008 financial crash and it’s aftermath. However, most of those people are actually in their late 30s now, and it’s important to note that state of affairs did not persist for those who came after them. Times change, sometimes for the better.

I would add two more points: one, there is also a factor in that many scholarships will only pay a percentage of the mandatory tuition and fees– for example, a scholarship that will pay up to $20,000 or 50% of the tuition and mandatory fees. By publishing a cost of $40,000, but actually only charging $30,000 (say), the student can still get the full $20,000 in scholarship from the outside agency. The second factor is, the number of people in the prime 18-24 age bracket is declining, and anecdotally, the academic quality of that group is also declining. This is particularly true in the northeast and midwest, where the density of colleges is highest. So, colleges are competing harder for smaller qualified cohorts– so resort to targeted discounts for prospective students who can get into higher-ranked universities.

–Janet

LikeLike

Excellent points! The competition point also underscores the impact of online schools, which can scale up to be huge competition for a much larger radius than a traditional school. Wiki tells me SNHU has 135,000 online students, which is two orders of magnitude higher than they were able to sustain when they were just a brick and mortar school.

LikeLike